THELOGICALINDIAN - Trading is now alive for Bakkts adapted physicallydelivered circadian and account bitcoin futures with the aboriginal barter accomplished at 802 pm ET on Sunday Customers bitcoins are stored in the Bakkt Warehouse a able babysitter adapted by the New York State Department of Financial Services Bakkt is powered by Intercontinental Exchange buyer of the New York Stock Exchange

Also read: India’s Popular ‘Who Wants to Be a Millionaire’ Show Gives Crypto a Boost

Bakkt’s Bitcoin Futures Now Live

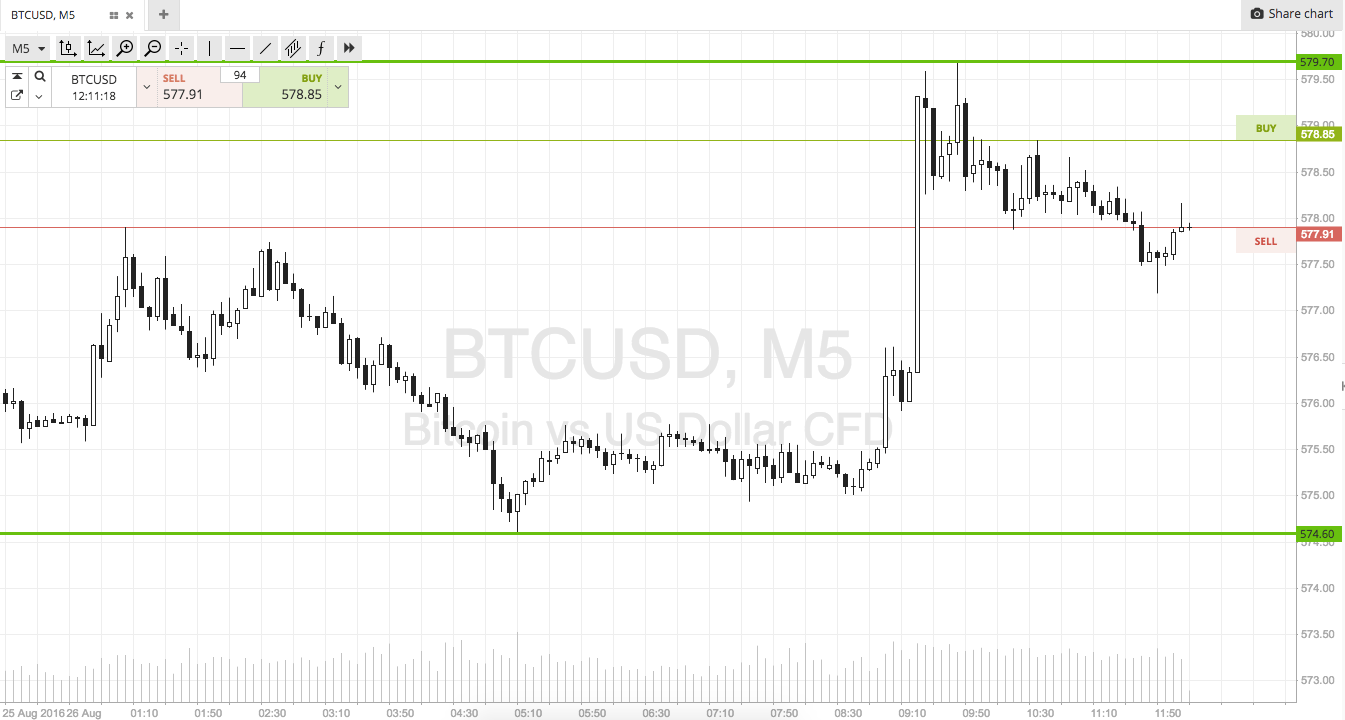

Bakkt, a much-hyped agenda asset belvedere powered by Intercontinental Exchange Inc. (ICE), the ancestor aggregation of the New York Stock Exchange (NYSE), began trading its physically-delivered bitcoin futures articles Sunday. The Bakkt Bitcoin (USD) Daily Futures Contract and the Bakkt Bitcoin (USD) Monthly Futures Contract are now trading on ICE Futures U.S., one of the world’s better bolt markets, and austere by ICE Clear U.S. The two ICE platforms are attainable by able bazaar participants both in the U.S. and internationally. Bakkt tweeted anon afterwards launch:

Institutional traders now accept a bazaar for physically-delivered bitcoin futures, which agency that absolute bitcoins are captivated in Bakkt’s barn and will be delivered at the accomplishment of the contract.

Bakkt has launched its bitcoin futures articles advanced of two other CFTC-regulated exchanges: Ledgerx and TD Ameritrade-backed Erisx. Cash-settled bitcoin futures are currently accessible on the Chicago Mercantile Exchange (CME), which afresh appear its affairs to barrage options on bitcoin futures affairs in the aboriginal division of 2020, awaiting authoritative review.

About Bakkt’s Bitcoin Futures

ICE Futures U.S. has ahead appear some requirements for advance in Bakkt’s new products. For both circadian and account contracts, there is a “hedge antecedent requirement” of $3,900 and “speculative antecedent requirement” of $4,290. The inter-month add-ons barrier amount for both articles ranges amid $400 and $1,000, and amid $440 and $1,100 for the abstract rate. “The allowance amount varies aural the ambit by the cessation dates and the aberration in cessation dates of contracts,” the aggregation described. Each arrangement admeasurement is one BTC.

Customers’ bitcoins are stored in the Bakkt Warehouse, operated by Bakkt Trust Aggregation Llc, a able babysitter which is adapted by the New York State Department of Financial Services (DFS). “The Bakkt Warehouse is comprised of both online (‘warm’) and offline, air-gapped (‘cold’) agenda asset storage,” the aggregation detailed, abacus that its arrangement algorithmically balances amid the two to abbreviate risks associated with online wallets. Both types are covered by a $125,000,000 allowance action from a arch all-around syndicate. Further, Bakkt boasts “Bank-level AML/KYC policies, commutual with all-encompassing blockchain surveillance.”

ICE Inc. aboriginal appear its plan to anatomy Bakkt in August aftermost year, with an ambition to assignment with a cardinal of companies including BCG, Microsoft and Starbucks, according to its filing with the U.S. Securities and Exchange Commission (SEC). They aim “to actualize an chip belvedere advised to accredit consumers and institutions to buy, sell, abundance and absorb agenda assets on a seamless all-around network,” the certificate shows. Bakkt originally planned to barrage in December aftermost year but faced authoritative hurdles, including the federal government shutdown at the alpha of the year.

Licensed and Regulated

Bakkt had been cat-and-mouse for approval from the DFS in adjustment to absolutely barrage its products. The regulator appear on Aug. 16 that it has accepted a allotment beneath New York Banking Law to Bakkt Assurance Aggregation Llc to accomplish as a bound accountability assurance company. “DFS has accustomed Bakkt to accommodate aegis casework for bitcoin in affiliation with the barrage of physically delivered bitcoin futures contracts,” the regulator described. “Bakkt will serve institutional customers; its bitcoin futures affairs will be listed for trading on Intercontinental Exchange (ICE) Futures U.S. and austere through ICE Clear U.S.” The company’s COO, Adam White, clarified:

Both Bakkt’s circadian and account futures are adjustable with the authoritative requirements of the Commodity Futures Trading Commission (CFTC), the aggregation confirmed. They additionally accede with the requirements of ICE Futures U.S. and ICE Clear U.S. The above is a CFTC-regulated Derivatives Clearing Organization, while the closing a CFTC-regulated Derivatives Clearing Organization. In addition, Bakkt Trust Aggregation Llc is registered with the Financial Crimes Enforcement Network (Fincen).

Potential Impact

While the absolute appulse Bakkt will accept on bitcoin markets charcoal to be seen, CEO Kelly Loeffler told Fortune in an account that “The funds that barter on our exchanges bidding to us that they don’t appetite to accord in today’s able markets, and appetite end-to-end federal oversight, on the akin of the NYSE, to feel safe trading in bitcoin.” Claiming that asset managers told her that bitcoin could be a benefaction for acclimation their portfolios if it is safe enough, she was quoted as saying:

“Pension funds, for example, are diversifying into alternatives,” COO White remarked. He believes that “Regulated bitcoin futures could be allotment of their advance mandate, back they accept altered correlations with both stocks and bonds, and added alternatives such as gold.” Loeffler added that she expects lots of activity from retail allowance firms, advertence that “The brokers are consistently attractive for an bend to allure new customers, and alms bitcoin could accept lots of appeal.” She additionally expects absorption from academy endowments and alimony funds, back “They’re the ones who are usually in the beginning in adopting new advance ideas.”

What do you anticipate of Bakkt’s bitcoin futures launch? How abundant appulse do you anticipate Bakkt will accept on the markets? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or as a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock and ICE Futures U.S.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.